Table of Content

The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. However, there are still some instances when a refinance makes sense. We’ll walk you through those cases, and where rates are likely to go next year.

These awards are funded through the FHLBNY’s Affordable Housing Program ... Interest on advances with maturities ≤ 6 months is due at maturity. Members can save on interest expense and support their funding strategy through our Advance Renewal Discount Program.

Privately Capitalized and Funded

It was created by the Federal Home Loan Bank Act of 1932, the first in a series of bills that sought to make homeownership an achievable goal for more Americans. The rationale was by providing banks with low-cost funds to be used for mortgages. They would be more likely to make loans; as a result, individuals would find it easier to borrow money to buy homes, thus stimulating the residential real estate market. The 11 regional banks comprising the Federal Home Loan Bank System, known as FHLBanks, are structured as privately capitalized corporations—specifically, cooperatives. They are owned by their members, local financial institutions which buy stock in the FHLBank.

In the event that the Change Date falls on a Saturday, Sunday or legal holiday, the Change Date shall be deemed to occur on the first business day next following such Saturday, Sunday or legal holiday. These rates are not APRs and do not factor in any closing costs or fees. During the subprime mortgage-induced 2008 financial crisis, for example, the FHLBanks did not require any government bailouts, as sister GSEs Fannie Mae and Freddie Mac did. In fact, as other sources of funding dried up, they increased their lending.

Why are mortgage rates falling if the Fed is still hiking?

In fact, mortgage and other long-term rates may keep falling over the coming months – assuming the Fed manages to get inflation under control so it is able to lower its benchmark rate again. The short and rather boring technical answer is that bond markets anticipated this rate hike many months ago. And as market factors largely dictate the costs of borrowing, the increase was already absorbed into home loan rates. The Federal Reserve raised interest rates by half a percentage point on Dec. 14, 2022, to a range of 4.25 to 4.5%, the seventh increase this year.

FHLBs also provide funding for rental properties, small businesses, and other neighborhood development initiatives, resulting in economic and employment growth, stronger local communities, and a higher overall quality of living. The Federal Home Loan Bank System is a consortium of 11 regional banks across the U.S. that provide a reliable stream of cash to other banks and lenders to finance housing, infrastructure, economic development, and other individual and community needs. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site.

What’s happening with mortgage rates?

This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. Careers With a focus on diversity and inclusion, the FHLBNY views career development not as an expense but rather an investment.

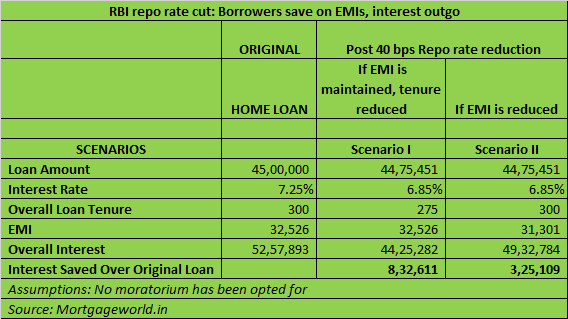

Monthly Mortgage Rate Calculator Check out the web’s best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes, homeowner’s insurance, HOA fees, current loan rates & more. Also offers loan performance graphs, biweekly savings comparisons and easy to print amortization schedules.

The high mortgage rates have pulverized the refinance market, as evidenced by the steady decline in mortgage refinance applications this year which are currently at their lowest levels since August 2000, according to the Mortgage Bankers Association . According to data released Thursday by Freddie Mac, the 30-year fixed-rate average plunged to 4.06 percent, with an. The Federal Reserve raised interest rates Wednesday for the fourth and final time this year.

Refinance Home Loans

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy. The offers that appear on this site are from companies that compensate us.

This uncertainty can be the result of a potential economic downturn, the possibility of the Fed raising rates more than expected, inflation, Fed balance sheet changes or all of the above – as happened in 2022. Even though 30-year mortgages can be held for three decades, most people sell their house or refinance within a decade, which means the investor who is receiving the mortgage payments is effectively investing in a 10-year bond. After soaring for much of 2022, mortgage rates and other long-term rates are starting to come down. Public Announcements A Partnership We Can Count On Peoples Bank of Seneca congratulates FHLB Des Moines on reaching this milestone and are proud to celebrate our partnership with you. A partnership that is felt by nearly every corner of every community we serve, from families to businesses to the school districts.

Members of our cooperative access low-cost funding that helps them manage their balance sheets and supply mortgage funding, which helps build and vitalize local communities. The community Investments department of FHLBank Indianapolis has played a pivotal role in providing safe and affordable housing to residents in Indiana and Michigan. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available.